Will Apple finally drop its AI hint? - Stock Markets

Apple expected to publish gloomy Q2 earnings on Thursday May 2 after the bell

Investors widely expect AI updates, but Apple has more important events on the calendar

Apple stock on the back foot

Apple’s stock has had minimal gains, only to fall again this year, and is now on track to end its fourth straight month in the negative region. When compared to the S&P 500 community, the iPhone maker lags behind top tech performers such as Nvidia and Meta platforms, with a year-to-date decrease of 13.3% and a nearly neutral year-on-year performance versus the S&P 500’s 22.6%.

There are two main reasons to explain its underperformance and those will undoubtedly steal the show again when the company publishes its Q2 earnings for the quarter ending March 2024 on May 2.

Sales in China disappointFirst, investors have been disheartened by its worsening reputation in Asia and particularly in China, which is Apple’s second largest market after the US. Recent data showed that its smartphone shipments to China dropped by 19% in the first three months of the year amid rising competition from local rivals such as Vivo and Honor. Its market share narrowed too, further sliding to 15.7% from 19.7% in the same period last year and marginally surpassing Huawei’s 15.5%, while the unusual $180 discount on the iPhone 15 models added more evidence of demand headwinds.

On the supply side, the US-China trade war is back on the rise and is poised to expand into the tech industry after the first round of tariffs were exchanged. Given that Chinese factories remain crucial in the supply chain, Apple's struggles may not go away soon, even though the company has started to explore new opportunities in India and Vietnam.

Artificial intelligence missSecond and foremost, Apple has been surprisingly one of the few tech giants that experienced the consequences of falling behind in the AI competition, or better to say, the cost of making investors think that it’s not keeping up with advancements such as ChatGPT. Specifically, the guidance provided in February did not disclose any dedicated commitment to developing a killer AI product. However, there was mention of ongoing work in that area, which will be showcased later in the year.

But it’s not too late yetYet, Apple has a history of innovation. The fall of Nokia in the early 2000s is a great example of how the iPhone maker, which was believed to have no chance in the industry, took the crown from a 150-year-old leading company with a vast supply chain network. In two years, Nokia was in crisis and almost a decade after Apple was trading publicly with a $1trn market cap.

Of course, it’s possible for Apple to experience a similar situation as the AI community develops rapidly. Yet, given its rich database and the enormous number of resources and expertise under its belt, Apple might still have the last laugh. Perhaps it prefers to hold a mysterious stance before it hits the competition with something bigger and more accurate.

AI plansInvestors might learn more about Apple’s AI vision during the earnings call. But it’s uncertain if Apple will reveal anything market-moving ahead of its important Worldwide Developers conference on June 10-14 and its product unveiling event in September. There is also the possibility of being late to amaze investors, even though rumours are already circulating about several upgrades with big AI doses.

Apple is eagerly expected to unveil its groundbreaking iOS 18 operating system, which will run a slew of AI features entirely on devices and not on cloud servers. The upgrade could be significant and perhaps a solution to its long legal battle over data privacy but unless it has unique capabilities, it may not be a gamechanger in the tech market as its rival Samsung is already promoting its own AI system-on-chip package. Moreover, incorporating Google’s Gemini or OpenAI’s ChatGPT to serve cloud-based services might help Apple save some time and resources, but could also be a signal that its own AI efforts are not fruitful.

The iPhone 16, the next Mac line with enhanced M4 chips, a smarter Siri, a better iPhone to Android communication, and new attractive features in its Vision pro headset, which did not make a great debut earlier this year, might be among the initiatives too.

Q2 EarningsAs regards its earnings, although those have been beating analysts’ forecasts over the past year, albeit marginally, its financial results were not as great as they used to be. Revenue has been declining since the last quarter of 2022 and after a bounce of 2% in the final quarter of 2023, the upcoming report is expected to reveal a larger 5.0% y/y downfall to $90bln and a 24% quarterly pullback from $119bln.

In terms of profitability, changes in net income were not impressive last year either, with analysts anticipating a 4% decrease to $23bln after two quarters of more than 10% growth. Earnings per share (EPS) might decline from $2.18 to $1.50 and slightly below last year’s reading of $1.52.

Although the group of holders has increased over the past two years, LSEG analysts give, on average, a buy rating to the stock. Apple's valuation metrics are also more attractive now, with the 12-month forward P/E ratio falling to 24.7x from nearly 30x in June 2023. This is weaker than Amazon's 38x and Nvidia's 31x, but moderately higher than the S&P 500's of 20x.

Technical analysis

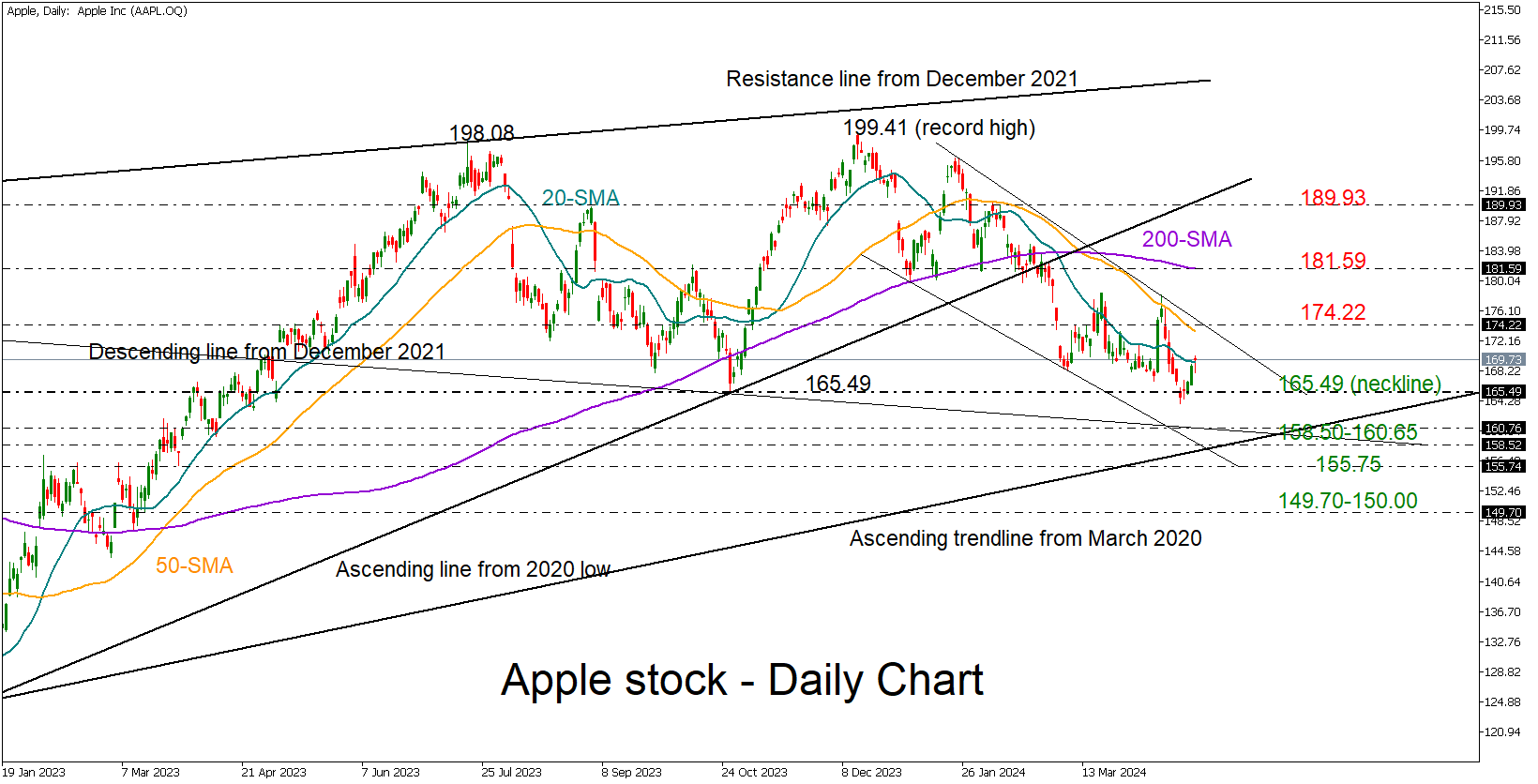

Technical analysis From a technical perspective, the short-term picture is not very encouraging as Apple’s 2024 downtrend has not found a bottom yet but the stock’s refusal to close below October’s low of 165.49, which seems to be the neckline of a bearish double top pattern in the weekly chart, is providing a ray of hope that a new bullish cycle is likely. A bounce above the 50-day simple moving average (SMA) and the resistance trendline at 174.22 could bring the 200-day SMA under examination at 181.59.

Alternatively, a drop below 165.49 could motivate more selling towards the 160.65-158.50 territory, where the support trendline from the pandemic lows is placed. If that floor cracks and the price retreats below 155.75 too, the sell-off might intensify towards 149.70-150.00.

Các tài sản liên quan

Tin mới

Khước từ trách nhiệm: các tổ chức thuộc XM Group chỉ cung cấp dịch vụ khớp lệnh và truy cập Trang Giao dịch trực tuyến của chúng tôi, cho phép xem và/hoặc sử dụng nội dung có trên trang này hoặc thông qua trang này, mà hoàn toàn không có mục đích thay đổi hoặc mở rộng. Việc truy cập và sử dụng như trên luôn phụ thuộc vào: (i) Các Điều kiện và Điều khoản; (ii) Các Thông báo Rủi ro; và (iii) Khước từ trách nhiệm toàn bộ. Các nội dung như vậy sẽ chỉ được cung cấp dưới dạng thông tin chung. Đặc biệt, xin lưu ý rằng các thông tin trên Trang Giao dịch trực tuyến của chúng tôi không phải là sự xúi giục, mời chào để tham gia bất cứ giao dịch nào trên các thị trường tài chính. Giao dịch các thị trường tài chính có rủi ro cao đối với vốn đầu tư của bạn.

Tất cả các tài liệu trên Trang Giao dịch trực tuyến của chúng tôi chỉ nhằm các mục đích đào tạo/cung cấp thông tin và không bao gồm - và không được coi là bao gồm - các tư vấn tài chính, đầu tư, thuế, hoặc giao dịch, hoặc là một dữ liệu về giá giao dịch của chúng tôi, hoặc là một lời chào mời, hoặc là một sự xúi giục giao dịch các sản phẩm tài chính hoặc các chương trình khuyến mãi tài chính không tự nguyện.

Tất cả nội dung của bên thứ ba, cũng như nội dung của XM như các ý kiến, tin tức, nghiên cứu, phân tích, giá cả, các thông tin khác hoặc các đường dẫn đến trang web của các bên thứ ba có trên trang web này được cung cấp với dạng "nguyên trạng", là các bình luận chung về thị trường và không phải là các tư vấn đầu tư. Với việc các nội dung đều được xây dựng với mục đích nghiên cứu đầu tư, bạn cần lưu ý và hiểu rằng các nội dung này không nhằm mục đích và không được biên soạn để tuân thủ các yêu cầu pháp lý đối với việc quảng bá nghiên cứu đầu tư này và vì vậy, được coi như là một tài liệu tiếp thị. Hãy chắc chắn rằng bạn đã đọc và hiểu Thông báo về Nghiên cứu Đầu tư không độc lập và Cảnh báo Rủi ro tại đây liên quan đến các thông tin ở trên.